Would I Join My Club Today?

A Viewpoint on Initiation Fees in the Post-Pandemic Era

For many private clubs, the years following the pandemic felt like a long-awaited reversal of fortune. Demand returned with force, waitlists reappeared, and initiation fees climbed, sometimes incrementally and sometimes dramatically. In many cases, momentum built faster than anyone expected. For boards and leadership teams, this was reassuring and, in some cases, even celebratory. Yet amid that momentum, one fundamental question often went unasked: would I want to and be able to join my club today at today’s initiation fee? Not as a board member, and not with years of emotional investment and institutional knowledge, but as someone encountering the club for the first time. That question has a way of cutting through optimism and getting to the heart of stewardship.

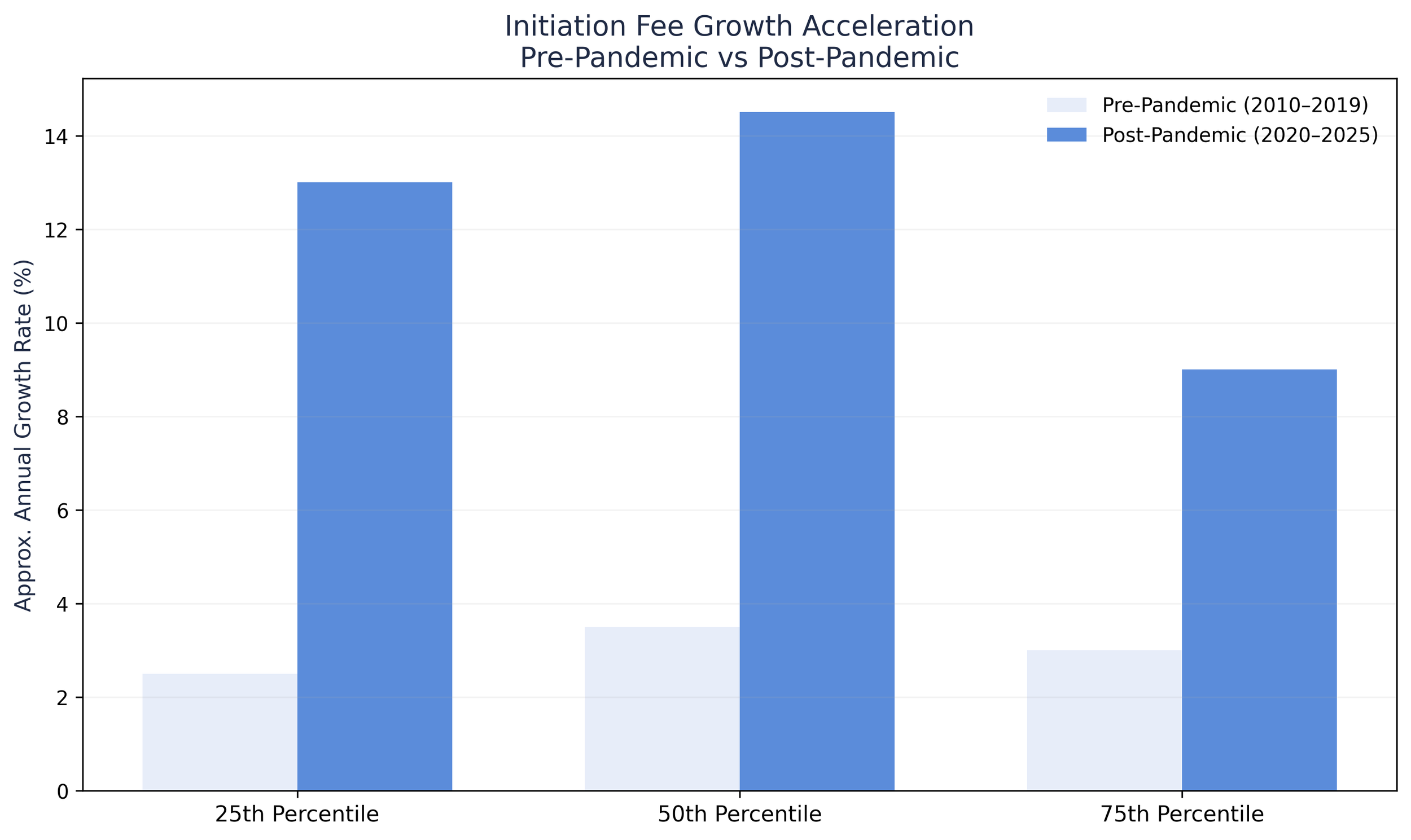

Initiation fee growth accelerated sharply after 2020, reflecting a structural shift in demand rather than gradual inflation.

Growth rates shown are directional, based on club benchmarking data.

From roughly 2010 through 2019, initiation fees across much of the industry moved cautiously. Growth was measured, and many clubs were still recovering financially and psychologically from the Great Recession. Then the pandemic altered how people think about time, community, wellness, and shared experience. Private clubs shifted from being nice to have to deeply relevant. For many families, they became anchors of routine, identity, and belonging. Demand did not simply return; it reset expectations. Between 2020 and 2025, initiation fees at the median club increased at nearly twice the pace of general inflation, tracking more closely with home price appreciation than CPI. That distinction matters because it tells us initiation fees are no longer just keeping up with costs. They are repositioning the club itself.

“The pandemic did not just increase demand for clubs. It changed what members expect from them.”

In many average clubs today, initiation fees play a meaningful role in capital planning. They help stabilize debt, support deferred maintenance, and reduce the need for assessments or sharp dues increases. None of this is inherently problematic. However, in some clubs, initiation fees now represent the majority of capital income. In a growing number of cases, they account for more than 75 percent. At that point, initiation fees are no longer a supplement. They become the plan. When capital depends heavily on initiation fees, the future of the club becomes tied to the next member paying more than the last. That is a strategic choice, whether it is explicitly acknowledged or not, and it raises a deeper governance question. Are we pricing access to protect the experience, or are we financing operations through turnover?

As initiation fees rise quickly, many clubs begin to develop two very different member experiences. There are tenured members who joined under a far lower economic threshold, and there are newer members who arrive having written a much larger check. Over time, that gap can surface in subtle ways, such as differing expectations around service, perspectives on assessments, and definitions of value and fairness. The issue is not whether higher initiation fees are justified. Often, they are. The issue is whether the board has intentionally reconciled what that price signals about who the club is for and how members are meant to relate to it. Culture rarely changes abruptly. It drifts quietly, shaped by incentives, assumptions, and unspoken norms.

Most boards ask reasonable questions. What are peer clubs charging? How long is our waitlist? What will the market bear? These questions matter, but they tend to focus on capacity rather than character. The more revealing question is simpler: would I join my club today if the initiation fee were $XXX? That question changes the conversation. It shifts attention from what the market allows to what the club represents. It forces reflection on accessibility versus exclusivity, confidence versus complacency, and whether pricing reflects the experience being delivered or simply the moment being lived.

“The more revealing question is simpler: would I join my club today if the initiation fee were $XXX?”

The clubs navigating this period most effectively are doing a few things intentionally. They benchmark initiation fees against real assets and member demographics, not just peer clubs. They stress-test capital plans for slower turnover and pricing normalization. They talk openly about who the club is today and who it intends to be in the future. Initiation fees send a powerful signal. They communicate value, belonging, and identity. The question is whether that signal is being shaped deliberately or inherited passively from market conditions.

The post-pandemic surge gave private clubs something rare: leverage. The clubs that will endure are the ones that use that leverage not only to increase initiation fees, but to increase clarity. Because in the end, the most honest test of long-term health may still be the simplest one.

Would I choose to join my club today?